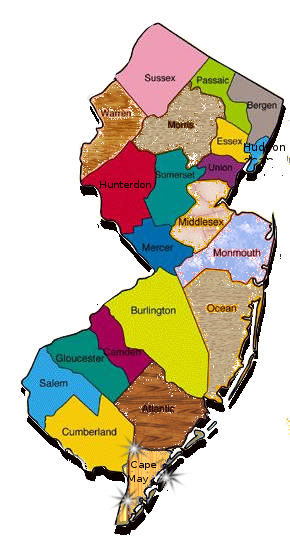

New Jersey and her counties

|

Cape May County |

Cape May County, NJ Property Tax Information

New Jersey

In the state of New Jersey the median property (home) is valued at $348,300.00. (translation 50% higher, 50% lower) tax upon such a home is $6,579.00 (avg.) per year. Counties in New Jersey collect an average rate of 1.89% of a property's assesed fair market value. (year 2022)

Cape May County

Averages ( 2021 )Residential property tax bill $,

Real Estate tax rate was . home value residential Cape May County $564,752.

| Location | Median Home Value, | Median Yearly Property Tax | Average Property Tax Rate(Percentage) |

| Cape May County | $564,752 | $4,472 | 1.51% |

| New Jersey | $348,300.00 | $6,579.00 | 1.89% |

| United States | $204,900 | $2,471 | 1.16% |

NJ Infomation based upon information from the state of NJ

| Municipality | Tax Rate | Tax Bill | Home AssessmentAverage |

|---|---|---|---|

| Avalon | 0.547 | $9,007 | $1,646,571 |

| Cape May | 1.018 | $6,722 | $660,277 |

| Cape May Point | 0.647 | $4,596 | $710,297 |

| Dennis | 1.746 | $3,245 | $185,870 |

| Lower | 1.812 | $4,220 | $232,900 |

| Middle | 1.864 | $4,582 | $245,807 |

| North Wildwood | 1.401 | $4,332 | $309,236 |

| Ocean City | 1.005 | $6,216 | $618,511 |

| Sea Isle City | 0.764 | $5,223 | $683,599 |

| Stone Harbor | 0.656 | $10,518 | $1,603,400 |

| Upper | 1.931 | $5,476 | $283,597 |

| West Cape May | 1.28 | $6,035 | $471,523 |

| West Wildwood | 1.822 | $4,486 | $246,233 |

| Wildwood | 2.755 | $5,660 | $205,458 |

| Wildwood Crest | 1.326 | $5,102 | $384,791 |

| Woodbine | 1.686 | $2,029 | $120,333 |

Cape May County Contact Information

7 N Main Street

P.O. Box 5000

Cape May Court House, NJ 08210-5000

Phone: 609-465-1010

Fax: 609-465-8625

My Direct Line ...Phone: 856. 974.1981

David Cohen

Sales associate with

Century 21 Reilly Realtors,

39 North Route 73,

Berlin, New Jersey 08009

United States of America

Sales associate with Century 21 Reilly Realtors,

39 North Route 73,

Berlin, New Jersey 08009

United States of America

Office 856.767.1776