Mercer County, New Jersey Real Estate Tax Rates

Mercer County, New Jersey Real Estate Tax Rates |

|

The home assessment in the county in 2021 was $361,547.(average)

The average real estate tax rate was 3.342. (average)

In the state of New Jersey the median property (home) is valued at $348,300.00.

tax upon such a home is $6,579.00 (avg.) per year.

Counties in New Jersey collect an average rate of 1.89% of a property's assesed at fair market value. (year 2022)

United States: Meduim Home Value:$204,900,

Meduim Yearly Property tax: $2,471,

Average property tax rate: 1.16%

| Municipality Town, Township | Tax Rate | Tax Bill Average | Home Assessment Average |

|---|---|---|---|

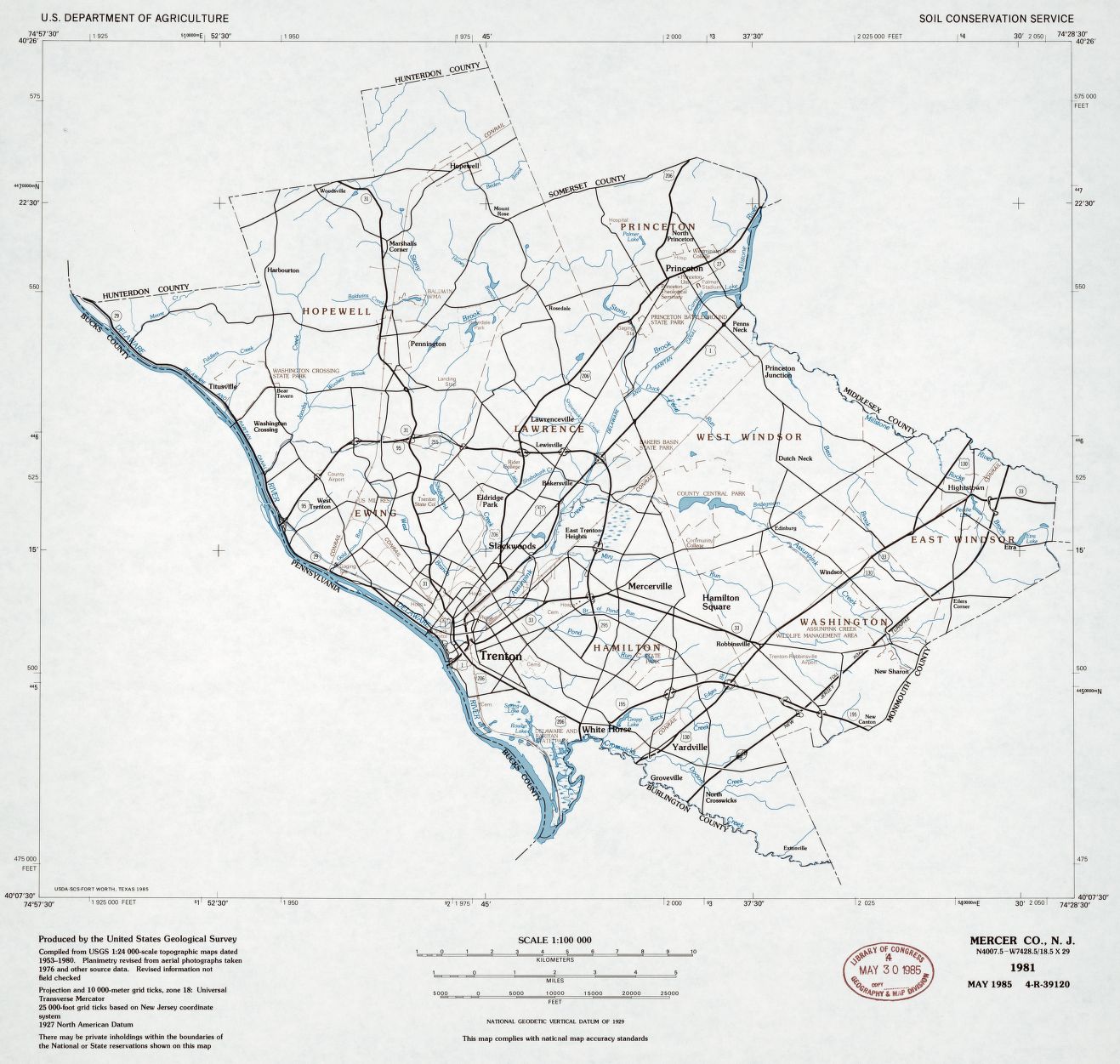

| East Windsor | 3.282 | $8,510 | $259,299 |

| Ewing | 3.509 | $7,110 | $202,609 |

| Hamilton | 3.263 | $7,029 | $215,409 |

| Hightstown | 4.516 | $9,689 | $214,558 |

| Hopewell | 3.071 | $12,492 | $406,761 |

| Hopewell Twp | 2.95 | $13,744 | $465,884 |

| Lawrence | 2.943 | $8,311 | $282,395 |

| Pennington | 2.762 | $13,519 | $489,454 |

| Princeton | 2.439 | $20,459 | $838,822 |

| Trenton | 5.553 | $3,463 | $62,364 |

| Robbinsville | 2.955 | $11,166 | $377,876 |

| West Windsor | 2.856 | $14,941 | $523,132 |