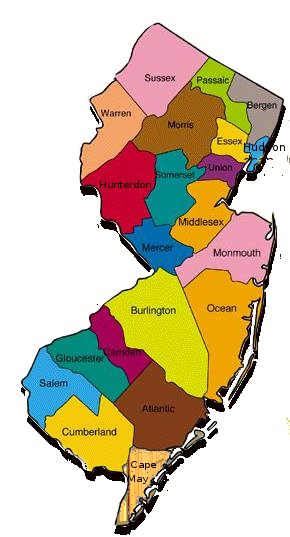

Residential property tax bill was $5,684. (average 2021)

Real estate tax rate was 3.633.(average 2021)

Salem County assessed average home value in 2021 was $167,193.

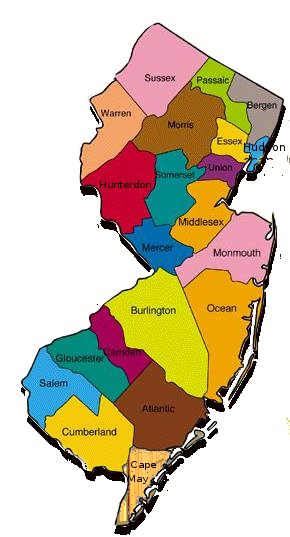

In the state of New Jersey the median property (home) is valued at $348,300.00.

tax upon such a home is $6,579.00 (avg.) per year.

Counties in New Jersey collect an average rate of 1.89% of a property's assesed at fair market value. (year 2022)

United States: Meduim Home Value:$204,900,

Meduim Yearly Property tax: $2,471,

Average property tax rate: 1.16%

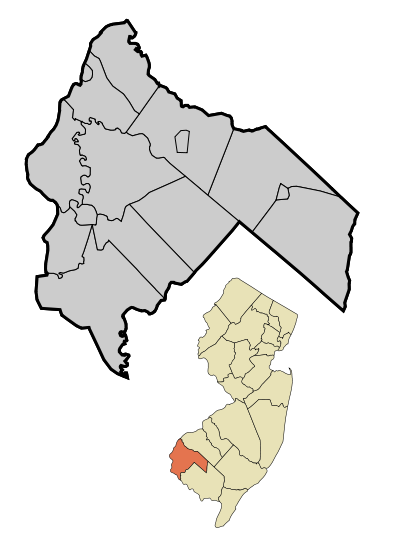

Municipality

city, townships | Tax Rate | Tax Bill

Average | Home Assessment

Average |

|---|

| Alloway | 3.116 | $6,041 | $193,863 |

| Carneys Point | 3.318 | $4,794 | $144,493 |

| Elmer | 3.754 | $6,255 | $166,633 |

| Elsinboro | 2.856 | $5,098 | $178,496 |

| Lower Alloways Creek | 1.621 | $2,073 | $127,895 |

| Mannington | 3.384 | $5,812 | $171,737 |

| Oldmans | 2.738 | $5,270 | $192,494 |

| Penns Grove | 4.944 | $4,264 | $86,249 |

| Pennsville | 4.623 | $7,087 | $153,308 |

| Pilesgrove | 3.365 | $9,124 | $271,135 |

| Pittsgrove | 3.738 | $7,016 | $187,691 |

| Quinton | 3.162 | $4,735 | $149,753 |

| Salem | 7.258 | $3,328 | $45,852 |

| Upper Pittsgrove | 2.798 | $6,534 | $233,519 |

| Woodstown | 3.825 | $7,832 | $204,770 |

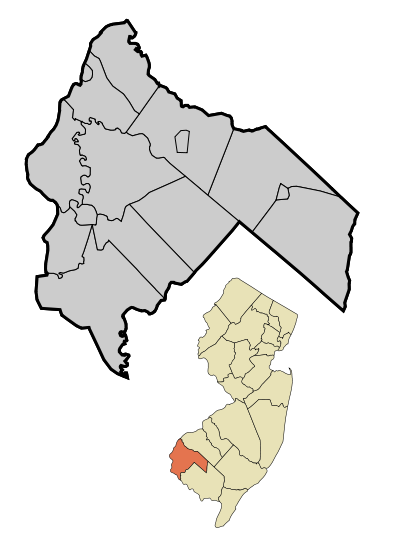

My Direct Line ...Phone: 856. 974.1981

David Cohen

Sales associate with

Century 21 Reilly Realtors,

39 North Route 73,

Berlin, New Jersey 08009

United States of America

Office 856.767.1776