property tax bill (average)was $11,400.

The average 2021 assessed home value in the county was $241,804.

In the state of New Jersey the median property (home) is valued at $348,300.00.

tax upon such a home is $6,579.00 (avg.) per year.

Counties in New Jersey collect an average rate of 1.89% of a property's assesed at fair market value. (year 2022)

United States: Meduim Home Value:$204,900,

Meduim Yearly Property tax: $2,471,

Average property tax rate: 1.16%

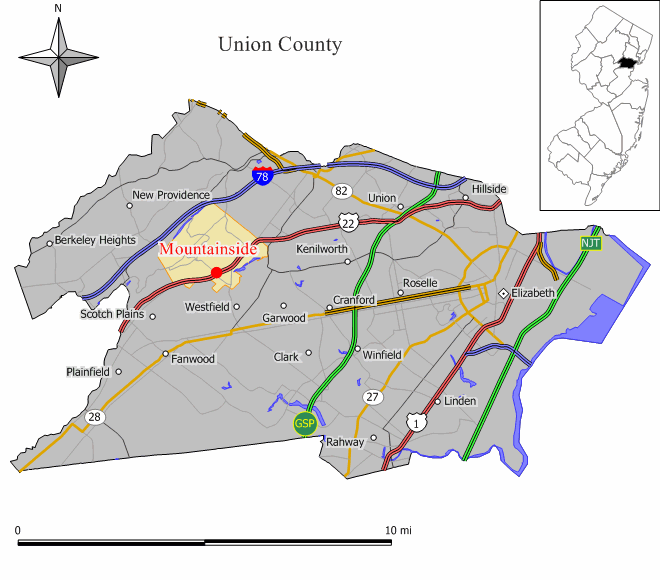

| Municipality | General Tax Rate | Average Tax Bill | Average Home Assessment |

|---|---|---|---|

| Berkeley Heights | 4.176 | $13,131 | $314,435 |

| Clark | 8.89 | $11,054 | $124,342 |

| Cranford | 6.583 | $12,157 | $184,672 |

| Elizabeth | 29.948 | $10,351 | $340,563 |

| Fanwood | 2.779 | $12,928 | $465,201 |

| Garwood | 2.558 | $10,274 | $401,628 |

| Hillside | 7.887 | $9,644 | $122,276 |

| Kenilworth | 5.211 | $9,556 | $183,389 |

| Linden | 6.949 | $9,185 | $132,174 |

| Mountainside | 1.964 | $12,224 | $622,393 |

| New Providence | 4.902 | $14,771 | $301,327 |

| Plainfield | 8.385 | $9,036 | $107,761 |

| Rahway | 6.951 | $9,323 | $134,124 |

| Roselle | 8.485 | $10,293 | $121,310 |

| Roselle Park | 4.114 | $10,415 | $253,162 |

| Scotch Plains | 11.266 | $13,964 | $123,944 |

| Springfield | 7.445 | $12,127 | $162,884 |

| Summit | 4.317 | $18,254 | $422,835 |

| Union | 20.409 | $9,445 | $46,277 |

| Westfield | 2.163 | $17,320 | $800,759 |

| Winfield | 21.403 | $3,942 | $18,418 |