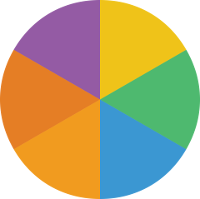

This person has all the pieces of the pie

This person has all the pieces of the pie

This person has all the pieces of the pie

This person has all the pieces of the pie

Tenancy by Entirety, Both members of the marriage has the same 100% of the pie

Tenancy by Entirety, Both members of the marriage has the same 100% of the pie

greatest feature of Joint tenancy with rights of survivorship (JTWROS)

A parent might convey property to all the children in their will

A life estate is for the life of a person. May or may not be for the life of the occupant.

The life tenant (owner) has most of the rights and all the responsibilities of an full owner. However, not the right to sell or encumber (mortgage etc) the property. After the death of the life of the person whos life the lenght of the life estate is based upon the intersest (ownership) is transfered to the remainder (the person the deed has designated)

Where as this is not a type of deed, it has a great effect upon ownership. 10 states of the United States of America are currently community property states. These states consider any assets obtained during marriage equally owned by both partners. Any liabilities obtain prior to or after marriage, both partners are equally responsible.

A trust where the real estate is the only asset.

There are General and Limited partnerships. A general partnership all members take part in the management and operations of the business. A limited partnership has a gerneral partner or partners plus limited or silent partners.

Definition according to the SBA, Small Business Administration: "A limited liability company (LLC) blends elements of a partnership and corporate structures to form a company that shields its owner (s) from personal liability. LLCs are a popular way to start a business, or a non-profit, because of their flexibility. Along with limited liability, an LLC has the advantage of pass-through income taxation." (www.sba.com/legal/llc/)

A corporation is an entity which holds ownership in property much as a individual person would.

A syndicate which is composed of two or more persons or firms is not a legal enttity within itself, but can be formed into one of many ownership types.

(note: different states have differrent laws check your particular states law)